Are you prepared for the unexpected? Life can throw curveballs when we least expect them, leaving us vulnerable and potentially unable to work. That’s why Disability Insurance exists – to provide a safety net and protect your financial well-being in the event of an unforeseen disability. Whether you’re self-employed or employed by a company, having Disability Insurance ensures that you have the necessary support to navigate challenging times and focus on recovery. In this article, we’ll dive deeper into the world of Disability Insurance, exploring its importance, benefits, and how it can help you maintain stability in times of uncertainty. So, let’s get started!

Understanding Disability Insurance

What is Disability Insurance?

Disability insurance is a type of insurance coverage that provides financial protection to individuals in the event that they become disabled and are unable to work. It is designed to replace a portion of your income if you are unable to earn a living due to a disability.

How Does Disability Insurance Work?

Disability insurance works by providing a monthly income replacement benefit to policyholders who become disabled and are unable to work. The amount of the benefit is typically a percentage of your pre-disability earnings, up to a certain limit.

To qualify for disability insurance benefits, you must meet the definition of disability outlined in your policy. This definition may vary depending on the insurance provider and the specific policy, but generally, it requires that you are unable to perform the duties of your occupation due to illness or injury.

Types of Disability Insurance

There are two main types of disability insurance: short-term disability insurance and long-term disability insurance.

– Short-term disability insurance: This type of coverage provides benefits for a limited period of time, usually up to six months. It is designed to provide temporary income replacement during a short-term disability, such as recovery from surgery or a non-work-related illness.

– Long-term disability insurance: Long-term disability insurance provides benefits for an extended period of time, typically until retirement age. It is intended to provide income replacement for individuals who experience long-lasting or permanent disabilities that prevent them from working.

Why is Disability Insurance Important?

Disability insurance is essential for anyone who relies on their income to cover daily living expenses, support their family, and save for the future. Here are a few reasons why disability insurance is important:

1. Protecting your income: Your ability to earn an income is one of your most valuable assets. Disability insurance ensures that you have a source of income if you are unable to work due to a disability.

2. Financial security: Without disability insurance, you may be faced with significant financial hardships if you become disabled and cannot work. Disability insurance provides a safety net, allowing you to maintain your standard of living and meet your financial obligations.

3. Peace of mind: Knowing that you have disability insurance can provide peace of mind, knowing that you are financially protected in the event of a disability. It allows you to focus on recovery and rehabilitation without the added stress of financial uncertainty.

Factors to Consider When Choosing Disability Insurance

When selecting disability insurance, it’s important to consider the following factors to ensure you choose the right policy for your needs:

1. Elimination Period: The elimination period refers to the waiting period before benefits begin. It can range from a few days to several months. Consider your savings and other resources to determine the most suitable elimination period for your circumstances.

2. Benefit Period: The benefit period is the length of time that benefits will be paid in the event of a disability. It can vary from a few years to age 65 or even lifetime coverage. Consider your financial goals and the duration of your disability when choosing the benefit period.

3. Definition of Disability: Review the policy’s definition of disability. Some policies have a stricter definition that may make it more challenging to qualify for benefits. Others offer more liberal definitions, providing greater coverage.

4. Residual or Partial Disability Coverage: Look for policies that offer residual or partial disability coverage. This coverage ensures that you receive benefits if your disability causes a reduction in your income or limits your ability to work full-time.

5. Cost and Affordability: Consider the cost of the premiums and ensure they fit within your budget. However, it’s important not to compromise adequate coverage for a lower premium.

Additional Considerations for Self-Employed Individuals

If you are self-employed, it’s crucial to take additional factors into account when considering disability insurance:

1. Business Overhead Expense Insurance: As a self-employed individual, you may want to consider business overhead expense insurance. This type of coverage helps cover ongoing business expenses, such as rent, utilities, and salaries, in case you become disabled.

2. Key Person Disability Insurance: If you play a vital role in your business, key person disability insurance can provide financial protection if you become disabled. It can help cover the costs of hiring a temporary replacement or offset any lost revenue during your absence.

Understanding Exclusions and Limitations

Before purchasing disability insurance, it’s essential to understand the policy’s exclusions and limitations. Common examples include:

– Pre-existing conditions: Some policies exclude coverage for disabilities related to pre-existing conditions, at least for a specific period.

– Self-inflicted injuries: Disabilities resulting from self-inflicted injuries or intentionally caused harm are typically not covered.

– Exclusions due to occupation: Certain high-risk occupations may have specific exclusions or limitations. Ensure that your policy covers any potential risks associated with your occupation.

– Waiting periods: Policies may have waiting periods before benefits are paid out. Review the waiting period and consider whether you have adequate savings to cover that period.

Disability insurance is an important form of financial protection that provides peace of mind in the face of unforeseen circumstances. It ensures that you have a source of income if you are unable to work due to a disability. By understanding the different types of disability insurance, factors to consider, and any exclusions or limitations, you can make an informed decision that suits your needs and provides the necessary coverage. Remember, it’s crucial to review and compare different policies to find the best disability insurance coverage for your specific situation.

Disability insurance explained: How it works and the types of coverage available

Frequently Asked Questions

What is disability insurance?

Disability insurance is a type of insurance coverage that provides financial protection to individuals who become disabled and are unable to work. It offers a steady stream of income to replace a portion of the individual’s lost wages due to a disability.

Who needs disability insurance?

Anyone who relies on their income to cover living expenses should consider disability insurance. It is especially important for individuals who do not have substantial savings or other financial resources to fall back on in the event of a disability.

What does disability insurance cover?

Disability insurance typically covers a percentage of the insured individual’s pre-disability income. The specific coverage and benefits may vary depending on the insurance policy. It may include both short-term and long-term disability coverage, providing financial support for a specified period or until the individual is able to return to work.

Can disability insurance be purchased through an employer?

Yes, many employers offer disability insurance as part of their employee benefits package. This type of disability insurance is often referred to as group disability insurance. Individual disability insurance policies can also be purchased directly from insurance companies or through insurance brokers.

Is disability insurance expensive?

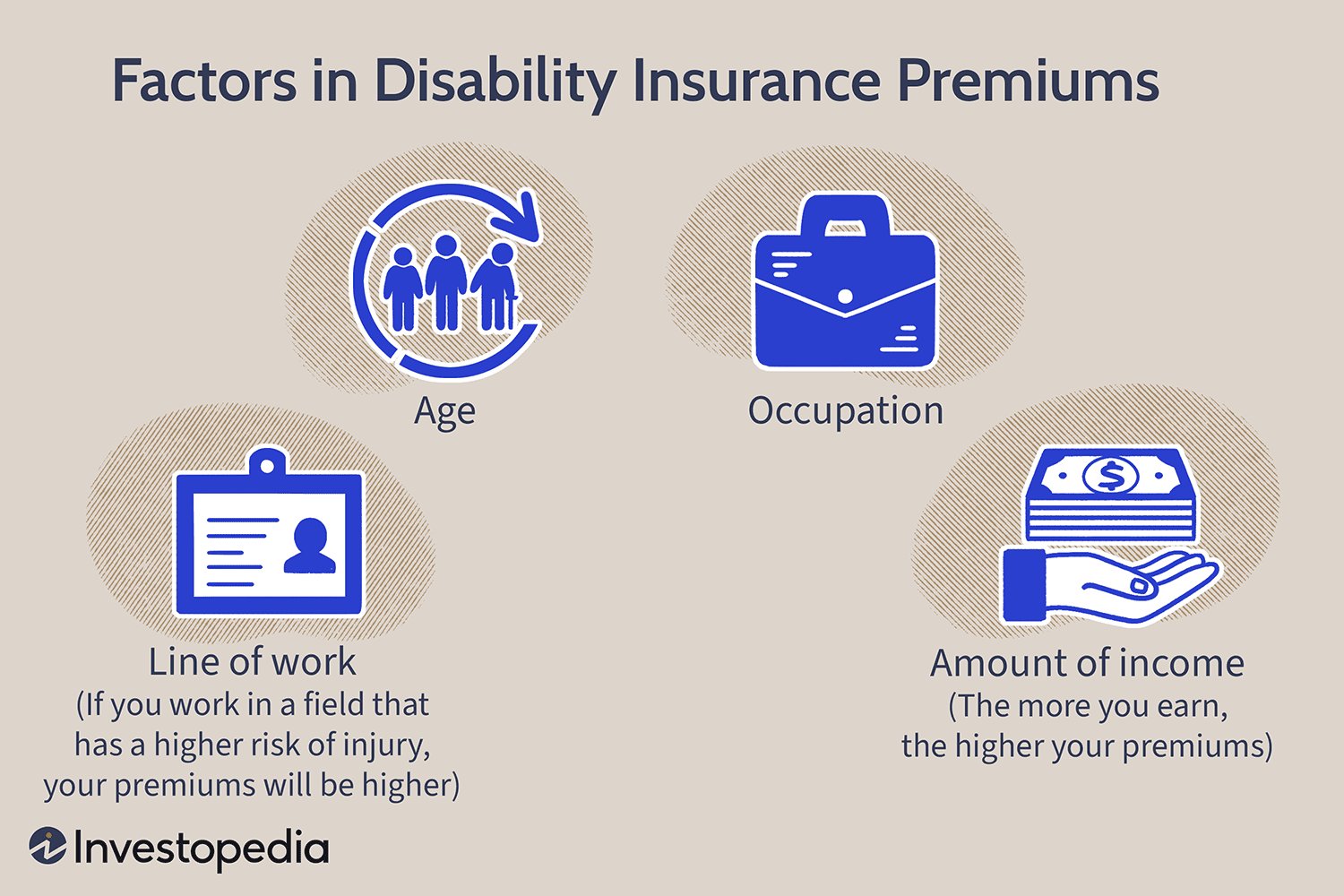

The cost of disability insurance can vary depending on several factors, including the individual’s age, occupation, health condition, and the coverage amount. Generally, the younger and healthier the individual is when purchasing the policy, the lower the premium will be. It is important to weigh the potential financial impact of a disability against the cost of the insurance premiums.

What is the waiting period for disability insurance benefits?

The waiting period, also known as the elimination period, is the initial period of time that an individual must wait before becoming eligible to receive disability insurance benefits. It can range from a few days to several months, depending on the terms of the policy. The waiting period is specified in the insurance policy and should be carefully considered when selecting a disability insurance plan.

Final Thoughts

In conclusion, Disability Insurance provides crucial financial protection for individuals in the event of a disability. It ensures that they have an income source to cover their expenses when they are unable to work due to a disability. Disability Insurance offers peace of mind and enables individuals to focus on their recovery without worrying about their financial well-being. It is a valuable investment for anyone who relies on their income to support themselves and their loved ones. With Disability Insurance, you can protect your financial stability and ensure your future security.